Home Flipping Activity Keeps Falling

Raw Flipping Profits Also Up, to High Point Since Middle of 2022

By The ATTOM Team

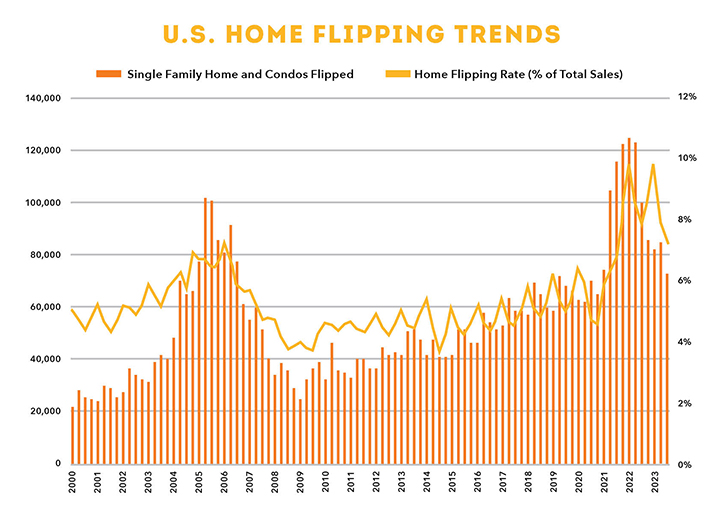

ATTOM, a leading curator of land, property, and real estate data, released its third-quarter 2023 U.S. Home Flipping Report showing that 72,543 single-family homes and condominiums in the United States were flipped in the third quarter. Those transactions represented 7.2%, or one of every 14 home sales nationwide, during the months running from July through September of 2023.

The latest portion was down from 7.9% of all home sales in the U.S. during the second quarter of 2023 and from 7.7% in the third quarter of last year. While the flipping rate remained historically high, it dropped for the second straight quarter, to the lowest point in two years.

But even as flipping rates declined, the latest analysis also revealed that fortunes continued improving for home flippers during the third quarter in the form of rising profits. Investor returns increased for the third quarter in a row, rebounding from a slump that had slashed profit margins by nearly two-thirds from early-2021 to late-2022. Margins, along with raw profits, rose to the highest levels since the middle of last year.

The typical third-quarter profit margin of 29.8% nationwide — based on the difference between the median purchase and median resale price for home flips — remained far below peaks hit in 2021. But it was up from 29% in the second quarter of 2023 and up seven percentage points from a low of 22.4% in the fourth quarter of last year.

Raw profits on typical flips around the country, meanwhile, increased to $70,000. That remained well down from a high of $110,000 reached in 2021. But it was up slightly from the second quarter of 2023 and was $15,000 more than last year’s low point.

“The comeback for the home-flipping industry is looking more like a real trend than a temporary break in what had been a pretty bleak couple of years,” said Rob Barber, CEO for ATTOM. “For sure, investment returns still aren’t anywhere close to where they were a couple of years ago. The latest nationwide profit margin also remains barely within the spread that covers the usual holding costs on flips, with wide variations around the country. Nevertheless, home flippers continue to head back in the right direction.”

Profits and profit margins again turned upward in the third quarter of 2023 as investors were able to benefit from shifts in prices that went in their favor from the time when they were buying their properties to the point at which they sold them.

Specifically, the typical resale price on flipped homes decreased to $305,000 in the third quarter, a 1.5% decline from the second quarter of 2023. But that drop-off was not as much as a 2.1% dip in median prices that recent home flippers were commonly seeing when they were buying their properties. The smaller quarterly decline in resale prices led to the improvement in profits and profit margins.

Home Flipping Rates Tick Downward in Three-Quarters of Nation

Home flips as a portion of all home sales decreased from the second quarter of 2023 to the third quarter of 2023 in 136 of the 183 metropolitan statistical areas around the U.S. with enough data to analyze (74%). Most of the declines were by less than two percentage points.

Among those metros, the largest flipping rates during the third quarter of 2023 were in:

» Macon, GA (flips comprised 16.1% of all home sales)

» Salisbury, MD (14.1%)

» Spartanburg, SC (13.3%)

» Atlanta, GA (13.2%)

» Fayetteville, NC (12.8%)

Aside from Atlanta, the largest flipping rates among metro areas with a population of more than 1 million were in:

» Memphis, TN (12.5%)

» Jacksonville, FL (10.8%)

» Phoenix, AZ (10.4%)

» Cincinnati, OH (10.2%)

The smallest home-flipping rates among metro areas analyzed in the third quarter were in:

» Seattle, WA (3.8%)

» Madison, WI (3.9%)

» Honolulu, HI (3.9%)

» Bridgeport, CT (4%)

» Lansing, MI (4.1%)

Regionally, the highest third-quarter flipping rate was in the:

» South (9.1%)

» West (8.1%)

» Midwest (6.5%)

» Northeast (5.2%).

Typical Home Flipping Returns Up in Half of U.S.

The median $305,000 resale price of homes flipped nationwide in the third quarter of 2023 generated a gross profit of $70,000 above the median investor purchase price of $235,000. That resulted in a typical 29.8% profit margin in the third quarter of 2023, up from 29% the second quarter of this year and 27% in the third quarter of last year (as well the recent low point of 22.4% in the fourth quarter of 2022). But the latest nationwide figure still remained far beneath the 60.8% level in the second quarter of 2021.

Profit margins went up from the second to the third quarter in 93 of the 183 metro areas analyzed (51%) and were up annually in 111 of those markets, or 61%.

The biggest year-over-year increases in typical profit margins during the third quarter came in:

» Akron, OH (ROI up from 50% in the third quarter of 2022 to 114.1% in the third quarter of 2023)

» Flint, MI (up from 61.6% to 113.8%)

» Canton, OH (up from 17.8% to 69.6%)

» Augusta, GA (up from 44.8% to 93.5%)

» York, PA (up from 61.5% to 107.5%)

The biggest annual increases in typical profit margins among metro areas with a population of at least 1 million were in:

» Birmingham, AL (ROI up from 35.4% in the third quarter of 2022 to 71.9% in the third quarter of 2023)

» Buffalo, NY (up from 75.6% to 109.7%)

» Cleveland, OH (up from 35.8% to 67%)

» Cincinnati, OH (up from 33.5% to 55.3%)

» Tulsa, OK (up from 32.3% to 53.8%)

The recent gains resulted in typical profit margins of below 30% in just 68, or about a third, of the 183 metros with enough data to analyze in the third quarter of 2023. That was far better than a year earlier, when half of those metro areas commonly had investment returns that low.

Metro areas with a population of at least 1 million and the weakest returns on typical home flips in the third quarter of 2023 were:

» Austin, TX (1.2%)

» Dallas, TX (4.9%)

» San Antonio, TX (5.7%)

» Houston, TX (8.1%)

» Salt Lake City, UT (11.2%)

Investors Earn Highest Raw Profits in West and Northeast

The highest raw profits on median-priced home flips in the third quarter of 2023, measured in dollars, were concentrated in the West and Northeast regions of the country. Twenty of the top 25 were in those regions, led by:

» San Jose, CA (typical gross profit of $355,000)

» San Francisco, CA ($249,000)

» Salisbury, MD ($231,015)

» San Diego, CA ($189,000)

» Bridgeport, CT ($165,000)

» New York, NY ($165,000)

The South dominated the opposite end of the range, along with the West. Those two regions had 24 of the 25 worst raw profits on median-priced transactions during the third quarter. The weakest numbers were in:

» Albuquerque, NM ($1,875 loss)

» Tyler, TX ($1,749 profit)

» Provo, UT ($2,120 profit)

» Austin, TX ($4,939 profit)

» Beaumont, TX ($6,062 profit)

All-Cash Investing by Home Flippers Increases Slightly

Nationwide, 62.9% of homes flipped in the third quarter of 2023 had been purchased by investors with cash. That was up from 62.3% in the second quarter of 2023, although still down from 63.7% portion in the third quarter of 2022. Meanwhile, 37.1% of homes flipped in the third quarter of 2023 had been bought with financing. That was down from 37.7% in the prior quarter, but still up from 36.3% a year earlier.

“All-cash flipping inched up a bit as average home mortgage rates rose by a full percentage point across the country during the third quarter following some small drop-offs earlier in 2023,” Barber noted. “With rates now dipping back down, the pressure to finance flips with cash is receding a bit. That could lead more investors back to financing their purchases, much as they did when rates were super low a couple of years ago.”

Among metropolitan areas with a population of 1 million or more and sufficient data to analyze, those with the highest percentage of homes flipped in the third quarter of 2023 that had been purchased with cash were in:

» Detroit, MI (79.7 %)

» Cleveland, OH (76.5%)

» Rochester, NY (73.4%)

» Cincinnati, OH (72.6%)

» Buffalo, NY (70.4%)

Average Time to Flip Nationwide Decreases by 17 Days

The average time it took from purchase to resale on home flips dropped to 161 days in the third quarter of 2023. That was down from 178 in the second quarter of 2023 and 165 days in the third quarter of 2022, to the smallest level since the fourth quarter of 2021.

One of Every Six Counties Have Home-Flipping Rates of at Least 10%

Home flips accounted for at least 10% of all home sales in 175, or 17.9%, of the 979 counties around the U.S. with at least 10 flips in the third quarter of 2023. That was below the 23.9% of all counties with enough data to measure in the second quarter of 2023. The leaders in the third quarter of this year were:

» Somerset County (Princess Anne), MD (22%)

» Lumpkin County, GA (north of Atlanta) (20.4%)

» Lamar County, GA (south of Atlanta) (20%)

» Cobb County (Marietta), GA (20%)

» Hopewell City/County, VA (19.4%)