The Housing Hunger Games

Why Speed Has Never Mattered More

By Jason Simpson

Anyone keeping a pulse on real estate can likely relate to the famous line from the movie Hunger Games, “May the odds be ever in your favor.” Never has this been truer than in today’s single-family rental (SFR) real estate investment market.

As demand for affordable homes surges, investors and individuals alike face extraordinary economic conditions and unforeseen challenges in securing properties. In this high-stakes environment, it seems like a contest, where success hinges on being there first to outpace the competition.

The Current Reality of Real Estate Investing

The inventory and availability of existing stock homes is dwindling rapidly while prices are scaling to insurmountable heights, and yet competition grows fiercer daily. Taking a few beats back to arguably our nation’s greatest leader, Abraham Lincoln, his wisdom holds true in today’s SFR real estate investment market: “Things may come to those who wait, but only the things left by those who hustle.”

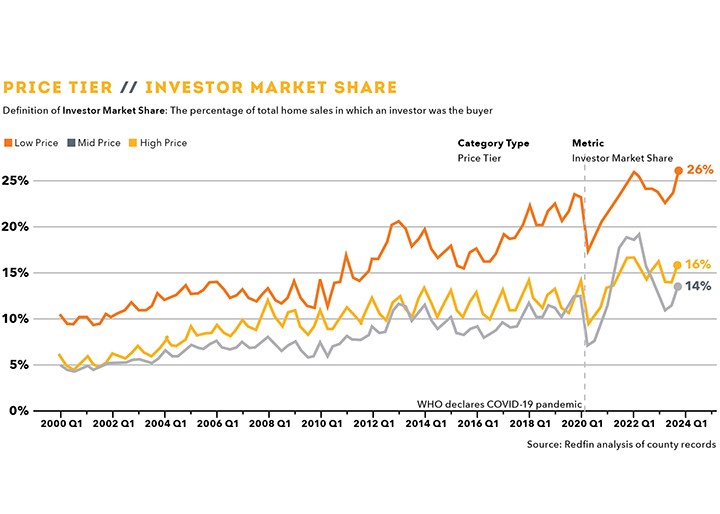

Young, first-time homebuyers, primarily in the 18-34 age bracket, vie for entry-level properties priced at a record high of $243,000 in 2023 according to the National Association of Realtors (NAR) and Redfin. With 77 million Americans from the Millennial and Gen Z cohorts hunting and hustling for starter homes, demand has soared to historic levels. Adding to the complexity, investors are also eyeing these affordable properties, with a staggering one in every four homes (26%) in this category now under investor ownership according to Redfin — a trend showing no signs of slowing down.

Consequently, the delicate balance between supply and demand has been severely skewed, with active listings across the U.S. plummeting to (nearly) record lows according to the latest Federal Reserve Economic Data (FRED).

This inventory scarcity is coupled with historically high prices — $417,500 the current median, also according to FRED data.

In addition, FRED data also reveals fewer than half of all (severely low supply) for-sale homes are in the affordable sweet-spot of starter home prices (avg. $215,000). Meaning, precious few starter homes are now also being simultaneously hunted by 77 million young Americans and investors too.

Speed Reigns Supreme

In this ruthless environment, where competition mirrors the intensity of the Hunger Games, speed reigns supreme. The solution lies in stimulating supply by incentivizing homeowners to “trade up,” thereby releasing more starter homes into market supply. While lower mortgage rates and innovative financing options may offer some help, the immediate imperative is crystal clear: act quickly to secure properties before your competitors do.

To thrive, investors must embrace technologies and services that streamline acquisitions. From identifying opportunities to conducting due diligence and crafting offers, every link in the acquisition chain must be fine-tuned for efficiency. By compressing the acquisition cycle and minimizing turnaround times, investors can secure a pivotal advantage.

This points to instant listing alerts and access to on-demand inspection resources, creating a rapid-response team ready to secure essential diligence insights and imagery for swift offer decisions. A team on the ground is also essential in optimizing speed-to-offer, especially for remote investors who can’t perform inspections themselves. Without a highly trained (and scalable) team—ready to mobilize as purchase opportunities arise—competitors will dominate and seize the better properties.

Readily available financing and offer capabilities are paramount to capitalizing on opportunities, as success in real estate investing boils down to a singular principle: speed. Those who move swiftly and adapt to a shifting market will triumph. Not only is speed to acquisition essential, but speed to fill vacant homes with renters is equally important.

Vacancy becomes a crushing element on any investor’s P&L and having resources ready to inspect and rehabilitate a property to put new renters under contract also becomes a key component of speed in your business cycle.

A defining feature of today’s real estate landscape is the staggering level of demand for affordable housing, particularly among younger demographics. Millennials and Gen Z comprise a significant portion of the population and are driving the surge in demand for entry-level properties. Often new in their careers, they face student debt and strive to achieve the American Dream of homeownership but are met with fierce competition, limited supply, historically high prices, and interest rates not seen since the first Bush administration. This creates a cocktail of competition for when the limited supply of homes does come open in their price range.

Simultaneously, investors, recognizing the potential for lucrative rental returns and low vacancy rates at this high-volume price point are turning their attention to the lower end of the market. The allure of affordable properties, coupled with the promise of rental income or appreciation, has spurred an influx of investment activity. As a result, starter homes once sought after by first-time buyers, are now subject to intense competition from cash-rich investors, further exacerbating the challenges faced by aspiring homeowners.

Temper Speed with Prudence and Foresight

With these obstacles, agility is key. Time matters and those who hesitate get left behind in the property race. Rushing into transactions without due diligence leads to costly mistakes and missed opportunities. Thus, investors must balance expediency and thoroughness, leveraging technology and data-driven insights to make decisions.

Technology is an indispensable tool for real estate professionals seeking a competitive edge. Immersive visual data, advanced analytics, AI, and ML algorithms empower investors to identify opportunities, assess risk, and transact with efficiency and precision. Plus, digital platforms and mobile applications offer seamless access to real-time market data, enabling investors to stay informed and agile in an ever-evolving landscape.

Crowdfunding platforms and online marketplaces have also democratized access to investment opportunities, allowing individual investors to participate in projects once exclusive to institutional players. This landscape diversifies capital sources and fosters innovation and entrepreneurship.

Nevertheless, amidst the proliferation of technology, it’s essential to remember that real estate investment remains rooted in human relationships and local knowledge. While data and analytics provide valuable insights, they must be complemented by a nuanced understanding of market dynamics, regulatory frameworks, and socio-cultural factors that shape the local context.

Ultimately, the pursuit of success in the contemporary real estate market demands a multifaceted approach that combines speed, agility, strategic foresight, and ethical responsibility. While speed is undeniably crucial in seizing fleeting opportunities, it must be accompanied by informed decision-making.

By leveraging technology, embracing innovation, and adhering to sustainable principles, investors can navigate the complexities of the market landscape and emerge victorious in the housing Hunger Games.