The “End Hedge Fund Control of American Homes Act”

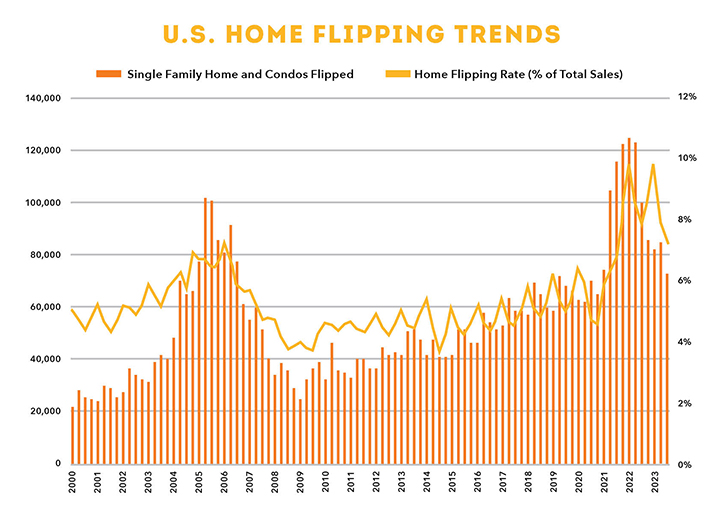

New Legislation Targets SFR Owners By David Howard In December, Senator Jeff Merkley (D-OR) and Representative Adam Smith (D-WA9) introduced the End Hedge Fund Control of American Homes Act, a bill targeting the legitimate development, investment, and ownership activities of America’s leading providers and builders of professionally-managed single-family rental homes and communities. By forcing any entity owning $50 million or more of single-family rental home assets to sell all properties

Read More