Millennial Home Buyer Report: 2023 Edition

What are the Barriers to Millennial Homeownership?

By Jaime Dunaway-Seale

Millennial home buyers can’t catch a break. After weathering two economic recessions that delayed their ability to buy a home, they entered one of the most expensive markets in U.S. history.

Fierce demand driven by historically low interest rates and limited inventory caused home prices to soar, and many millennials were priced out of the market or outbid by wealthier buyers.

To tame a hot market, the Federal Reserve began raising interest rates in March 2022, but millennials — the perpetual victims of poor timing — found little relief. The central bank’s move successfully dulled the home-buying frenzy of the pandemic market but triggered a host of new headaches.

Now, high interest rates are millennials’ No. 1 obstacle to owning a home, according to our recent survey of 1,000 home buyers. Meanwhile, just 29% of millennials — compared to 59% in 2022 — expect buyer competition to be a barrier to homeownership in 2023.

We found that millennials are being hit hard by the one-two punch of record inflation and expensive borrowing costs. Nearly all millennials (92%) say inflation has altered their home-buying plans, with more than 1 in 4 (28%) delaying their search as a result.

Three-fourths of millennials (75%) think the housing market is in a bubble that could burst in 2023, ushering in an era of greater affordability. But experts suggest tempering that expectation. Home prices are unlikely to plunge drastically, and borrowing may become even more expensive as additional interest rate hikes are on the way.

It’s not easy to find a home in such conditions, and nearly 3 in 4 millennials (71%) say home buying makes them feel stressed. A majority of millennials (51%) have been reduced to tears during the home-search process, and 44% say it has negatively affected their personal relationships.

To learn more about millennial home buyers, we asked Americans who are planning to purchase a home in the next year about their plans, anxieties, and compromises they’re willing to make.

We compare this data with previous years to provide a clear snapshot of how millennials are contending with new obstacles in a changing market. »

To view the report in its entirety, please visit: https://www.realestatewitch.com/2023-millennial-home-buyer-report/

Sidebar

Millennial Home Buyer Statistics

47% — Nearly half of millennials say high interest rates are a significant barrier to homeownership.

28% — Buyer competition is no longer seen as a barrier to homeownership, indicating a changing market. Just 28% of millennials say it’s an obstacle, compared to 59% in 2022.

82% — Millennials who have regrets about their purchase.

62% — Almost two-thirds of millennials plan to put down less than 20% on a home. Only 34% of millennials did the same in 2022, when they faced stiff competition with other buyers.

54% — More than half of millennials have less than $10,000 in savings — a percentage that has tripled since 2022, when only 18% of millennials had that little.

20% — About 1 in 5 millennials have $0 in savings.

86% — The percentage of millennials who would buy a home sight unseen dropped slightly from 90% in 2022.

65% — Millennials who would buy a fixer-upper — a sharp decrease from the 82% who said the same in 2022.

16% — About 1 in 6 millennial homeowners who bought a fixer-upper regret it.

23% — Nearly 1 in 4 millennials plan to buy a home that costs more than the national median of $455,000. To afford such expensive homes, 1 in 3 anticipate maxing out their budget.

14% — For their dream home, 1 in 7 millennials would offer $100,000 or more over asking price, a slight decrease from the 1 in 6 respondents (17%) who said the same in 2022.

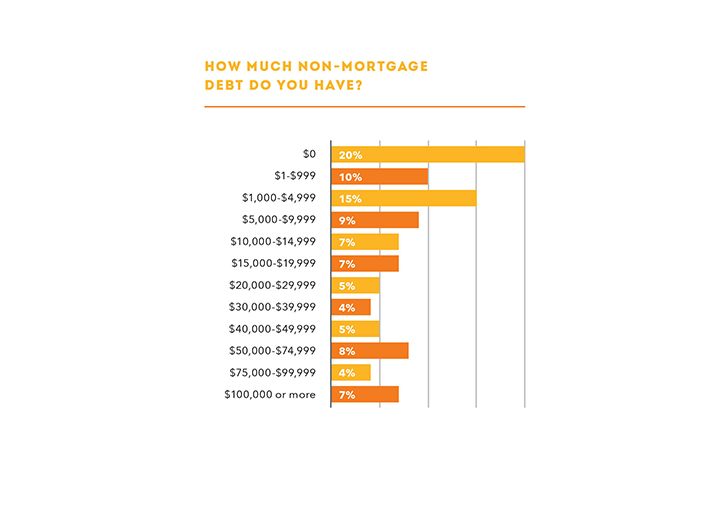

46% — Debt remains a looming barrier to homeownership among millennials, with nearly half owing $10,000 or more.