A Generational Shift in Housing

The Trend Toward Renting vs. Owning

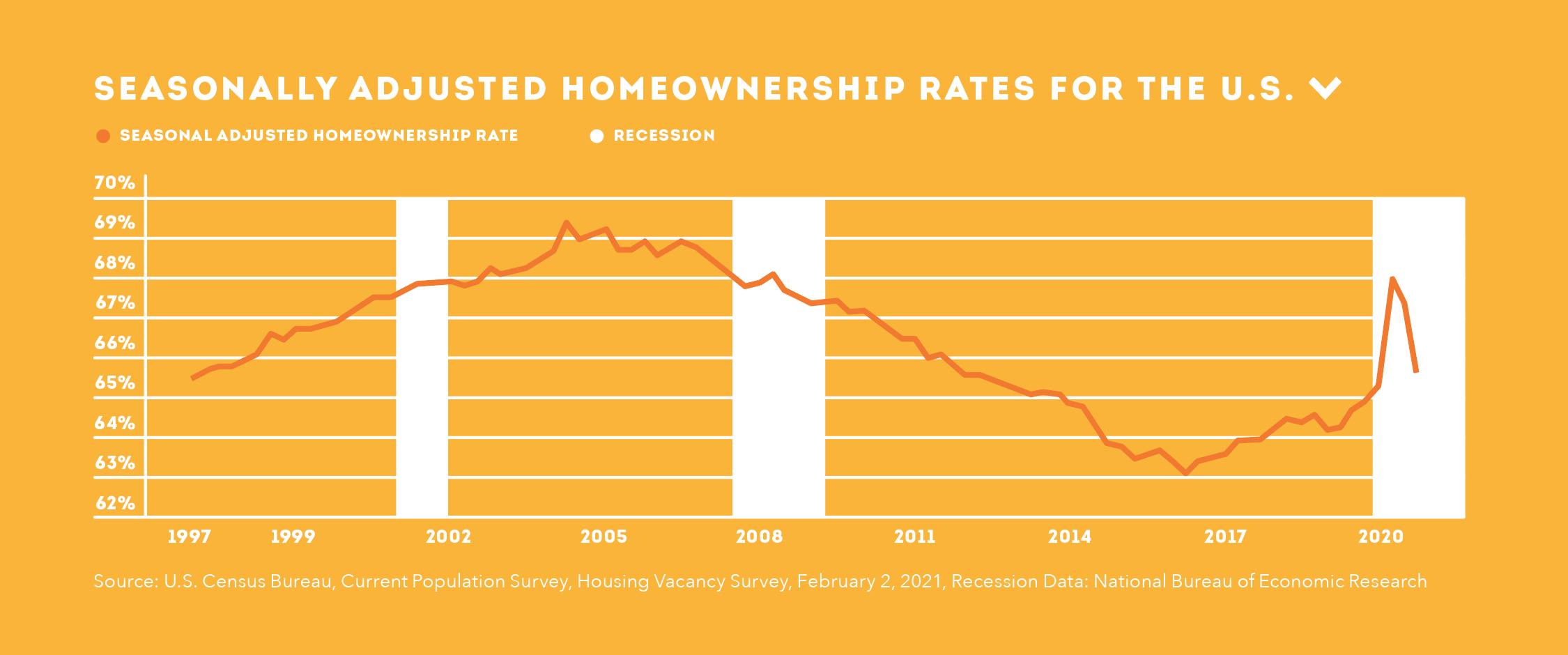

The home ownership rate in the U.S. today stands at 65.8%, which is up year over year. But it is a far cry from its height in early 2004, when it stood at just about 70%. Overall, the trend toward homeownership is down. This trend in U.S home ownership did not happen organically. It was not propagated by consumer demand or sentiment related to the lifestyle choice of owning vs renting. It was propelled by the bursting of the U.S housing bubble, putting millions of people into foreclosure, and thrusting them into the rental market, creating new consumer demand for residential rental homes. A trend that has seen an uptick over the last year was people moving from more densely populated areas and into the suburbs, thus creating an even higher demand for Single Family Rentals. Looking back to this trend, aside from the boom in foreclosures that happened during the 2008 downturn and the resulting increase in rental demand that followed, something more subtle sprang from the ashes of the housing bust and continues today in our post COVID world. And that is an undercurrent in the buying habits of the next generation of would-be homebuyers, those who are now opting to rent homes rather than own them. This shift, simply put, started with the recognition of a simple truth about the U.S housing market which was muted prior to 2008 by decades of government backed pro-housing public relations. That long forgotten truth…home prices can actually decline. That idea, so estranged from previous generations, is now affecting a generational shift in housing. And it is this shift that millions of investors (including some of the largest institutional investors) are now riding, a once-in-a-lifetime opportunity for those who understand the genesis of the shift and how to play it in the years to come.

A Historical Perspective

Let’s take a step back so we can get a bird’s eye view of where the trend toward renting vs. owning started. The housing bubble burst of 2007 caused a wave of defaults on loans made to “sub-prime” borrowers. These loans, made by lending giants at the time such as New Century Corp. and Countrywide Home Loans, were the product of a little-known subset of the bond market which traded in Mortgage-Backed Securities. Firms such as Lehman Brothers, Bear Stearns and Merrill Lynch were packaging subprime loans into bonds backed by the payments made by the borrowers of the loans and selling them off to other institutions who bought them knowing little more than they were rated AAA by the rating agencies (a rating that denoted the underlying securities carried essentially no risk). This commission-driven bond trading apparatus created massive demand for the very sub-prime loans that backed them, which in turn fueled the supply of cheap money that lenders were offering to less-than-credit-worthy borrowers. The macro-economic trend that had taken hold was that loans being made to people that, when the teaser period for loans expired would not be able to afford the payments, would inevitably default. Once the defaults started happening in early 2007, the collapse of the securities backed by these loans led to the collapse of some of the very firms that created them and the eventual bail out of the rest that survived.

Fast forward to 2010. Foreclosures on the homes owned by defaulted borrowers were happening at record levels. Home prices in the markets most affected by the foreclosure boom decimated home prices in those markets, turning homeowners into renters. Firms hungry to snap up those foreclosures at record low prices initiated an institutional trend in residential real estate that would later be dubbed “REO to Rental”. This trend would see hundreds of thousands of single-family homes bought by institutional investors and then turned into rentals, available to be tenanted by the very people that used to own them.

As the inventory of distressed homes dissipated in the early 2010’s, investors that saw the housing play as a trade were starting to realize Single Family Home rentals could be a long-term business. The moniker “REO to Rental” would eventually morph into the industry’s current description, “Single Family Rental”, as a reflection of the shifting views and strategies of the large rental home aggregators. This shift away from buying housing to generate a short-term profit and toward viewing it as a long term and operationally minded business, may on its surface seem to be a bet on the health of the U.S housing market. But that is only half the story. This shift in strategy was less about investors taking a long position on the prices of U.S housing as it was a vote on the continued growth of the U.S Single Family Rental Market.

A Bull Market

So why be bullish on the growth of the Single Family Rental Market? The proof is in the numbers. Although the U.S homeownership rate hit its lowest level in late 2016, residential housing starts had reached record highs and demand for homes was outpacing supply in most markets across the country. This coincided with an uptick in homeownership from 2016 to mid-2020 after which time, according to the U.S. Census, there was a steep decline down to where it sits today. In terms of supply shortage, which has steadily declined throughout the uptick and down tick in homeownership rates since 2016, investors are the reason. They snapped up inventory at multiple price levels to keep up with the growth in demand for rental housing. And throughout this time of rapid portfolio expansion by the large SFR aggregators, vacancy rates, which is a direct correlation to the demand of their homes by tenants has stayed steady. Everywhere you look, evidence of a boom in renter demand can be seen.

According to a report released by the U.S Census Bureau in February 2021, this is the lowest that vacancy rates have been in almost 20 years. National vacancy rates in Q4 of 2020 reached 6.5% for rental housing, down (from about 7%) from the same time in 2019. This is the lowest level in the last 20 years. Recently, building permits for single family homes, a gauge of future construction, climbed to its highest level ever in Q1 2021. A notable trend that has emerged in Single Family construction is single-family homes built-for-rent, of which starts have been on a steady ascent for consecutive quarters. BTR comprised 6% of new construction starts as of Q2 2020, this number was 3.9% as a percentage of the overall single-family home starts in Q3 of 2015 according to a report released by the National Association of Homebuilders. This dichotomy of historically low home ownership rates and historically high demand for homes coupled with a robust demand for rental housing points to a large and stable market for rental homes.

A Paradigm Shift

The headlines from mid-2020 until today have been focused on a population shift away from cities and out to the suburbs due to the need for more space as a respite from COVID. This shift has resulted in billions of dollars being poured into the Single-Family Rental space from incumbent SFR REITS like Amhurst, Progress Residential and Tricon, as well as new entrants hungry to gain exposure to the US housing and renter market. The entrants range from regional operators funded by private equity capital to prior corporate team members from larger SFR aggregators starting new fund ventures, to Multi-Family firms now looking to take infrastructure built for traditional apartment complexes and gear them toward the management of rental homes. But if you think the trend toward renting vs owning starts and ends with COVID, I think you are missing the larger picture. For anyone that was in their teenage years during the housing crash, with reason enough to know what happened from a variety of sources, whether it was from having personal experience from losing a home to foreclosure or experiencing the massive stress that this time caused for a parent, these events shaped their views toward home ownership. The idea that owning a home is always a good financial endeavor as was the widely held belief for many generations past, is not the view held by many that are now in their 20’s or early 30’s. This trend toward renting vs owning, although made more visible by the onset of COVID, would be happening regardless of the pandemic.

The American dream is being reimagined by many. It is no longer just about owning a home, building equity, and living in a house for an extended period. The American dream is now about mobility; the freedom to choose how and where you want to live. In a time when many people are no longer tethered by a job to a single city, the choice to rent a home and enjoy the freedom that renting brings, is a trend that is here to stay.

For more information about this topic, please visit www.stratasfr.com