National Private Lender Association Conference

March 7-9, 2024 // Miami, Florida The Largest NonBank Lending Conference

Read More

March 7-9, 2024 // Miami, Florida The Largest NonBank Lending Conference

Read More

Long-Term Success is Still Extremely Viable By Nate Zielinski Over the past two years, the U.S. economy has been like a simmering pot of water that has yet to reach its boiling point. There was a spike in interest rates across the country and inflation began to creep in and be noticeable in daily life for Americans everywhere. A lot of different facets of the economy were affected and real

Read More

Always Do What You Say You Are Going to Do and Do it With Integrity Tim and Melissa Swartz are independent business owners with HomeVestors® of America, Inc. in the Columbus, Ohio, market, and Melissa is currently serving as the Ad Council President for that area. The couple started their HomeVestors business, HumbleBee Properties, LLC in 2017 after each having successful careers in business and education administration. Their driving factor

Read More

Some Proposals for Consideration By David Howard This year’s State of the Union address featured a number of proposals designed to invigorate America’s housing market. Most notable among the proposals: » A two-year mortgage relief credit of up to $10,000 for first-time homebuyers » A one-year tax credit of up to $10,000 for homeowners who sell a starter home to owner-occupants » Up to $25,000 in downpayment assistance for first-time

Read More

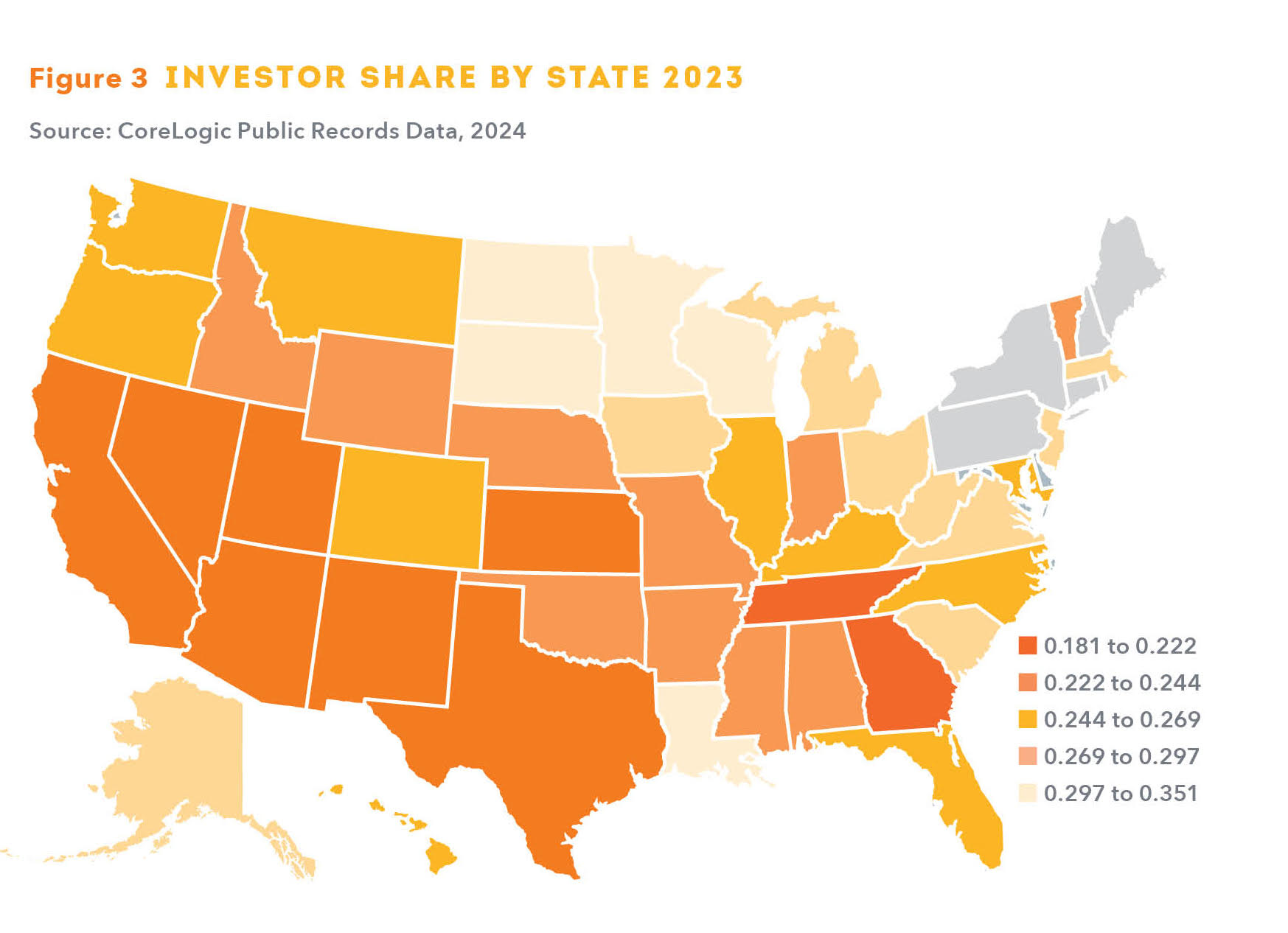

Small Investors are Gradually Regaining Their Market Share By Thomas Malone The high U.S. home investor share seen over the past two years nudged up higher to close out 2023. In December, the share of single-family purchases that were made by investors hit 28.7%, an all-time high in CoreLogic’s data that dates to 2010. This was a clear rise over the Fall share and raises the possibility that the share

Read More

More Americans Placing Higher Value on Renting than Home Ownership By Entrata Staff Entrata, a leading AI-enabled multifamily industry operating system, announced The New American Dream report, which found that the American Dream is changing as more people are renting by choice and not because they can’t afford to own a home. In fact, 20% expect to be lifelong renters, an increase of 33% percent from 2021 (15%). This further

Read More