Updates to Conforming loan limits mean 2 million U.S. homes no longer require a jumbo loan

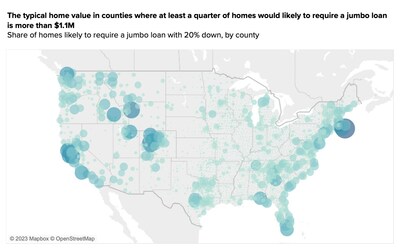

This could open up more home options for buyers shopping at higher price points and hoping to avoid the additional fees of a jumbo loan More than 2 million homes across the country no longer require a jumbo loan, according to a new analysis by Zillow Home Loans. This means customers will have additional available inventory that is covered by a more accessible financing option. The change is due to the Federal Housing Finance Agency’s (FHFA) recent increase of conforming loan limits to $1,089,300 in some high-cost markets. The news may be welcome for buyers looking to purchase a home this coming shopping season, as jumbo loans often come with additional fees and more stringent qualification standards, making them less affordable for most buyers. The FHFA increased the limits on the home price that qualifies for a conforming loan, which is the largest amount a mortgage company can lend to a borrower and still sell the loans conventionally to Fannie Mae and Freddie Mac. Compared to conforming loans, jumbo loans typically require a higher credit score — 700 is the minimum score that many lenders accept for a jumbo loan, versus the score of 620 that many require for a conforming loan. Bigger down payments are also the norm with a jumbo loan: Jumbo loans often require 20% down, although some call for even higher down payments. Some jumbo loans also will require proof of larger cash reserves than conventional loans (up to 12 months worth). For the majority of the country, the conforming loan requirement increased by $79,000 — going from $647,200 in 2022 to a baseline of $726,200 in 2023. In the most expensive parts of the country (103 counties), the conforming loan limit was raised to $1,089,300, topping the $1 million mark for the first time. These counties are largely concentrated in the nation’s most expensive metro areas, along the coasts and in the Mountain West. These updates to loan limits come within a changing housing market. While home price appreciation has slowed, home prices are still significantly higher than a year ago. Affordability challenges weighed heavily on home sales in the second half of 2022 — the number of listings that went pending in November fell by 16.5% from October and are down 38% compared to last November. “The addition of 2 million homes that now qualify for conforming loan options across the county is welcome news for home buyers entering a shopping season with fewer homes on the market,” said Nicole Bachaud, Zillow Home Loans senior economist. “Home price appreciation has slowed significantly, and this means that homes nearing jumbo loan territory will stay eligible for conforming loans longer than we have seen in the last few years.” A recent survey from Zillow Home Loans shows that prospective buyers spend nearly as much time researching their next TV purchase as they do their mortgage lender. Home buyers looking to purchase in the next year can take steps now to research and prepare for their mortgage as they get started on their home-financing journey, including: “Buyers should educate themselves about loan limits in their area and speak with qualified loan officers so they are making informed choices about their home purchase and the best loan option for their personal financial situation,” said Bachaud. Source: Zillow

Read More