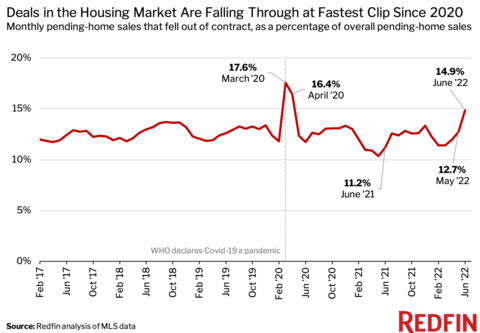

Home Sales Are Getting Canceled at the Highest Rate Since the Start of the Pandemic

Some homebuyers are backing out of deals as a slowing housing market gives them more room to negotiate. Nationwide, roughly 60,000 home-purchase agreements fell through in June, equal to 14.9% of homes that went under contract that month, according to the latest analysis from Redfin (www.redfin.com), the technology-powered real estate brokerage. That’s the highest percentage since March and April 2020, when the housing market all but ground to a halt due to

Read More