Foreclosure Activity

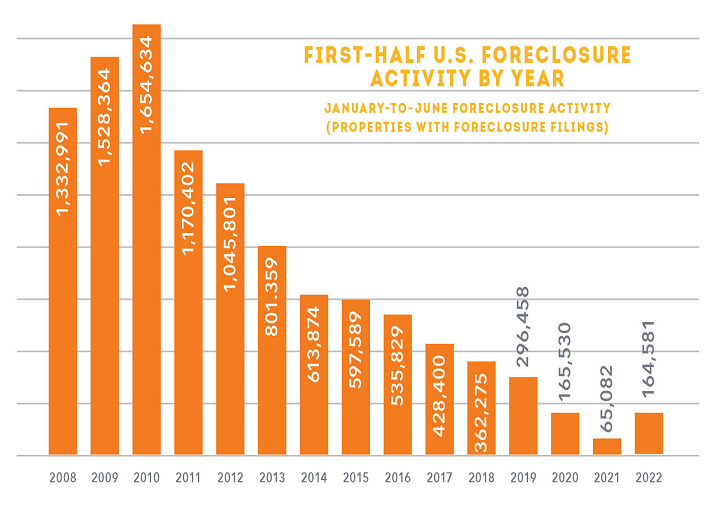

Foreclosures Rates Highest in Illinois, New Jersey and Ohio By ATTOM Staff ATTOM, a leading curator of real estate data nationwide for land and property data, released its Midyear 2022 U.S. Foreclosure Market Report, which shows there were a total of 164,581 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2022. That figure is up 153% from the

Read More