CREFC Q4 2022 Survey Shows Improving Sentiment for CRE Finance Markets

The CRE Finance Council (CREFC), the industry association that exclusively represents the $5.5 trillion commercial and multifamily real estate finance industry, announced the results of its Fourth-Quarter 2022 CREFC Board of Governors (BOG) Sentiment Index. The Sentiment Index, initiated in the fourth quarter of 2017, captures the pulse of various industry constituents, including balance sheet and securitized lenders, loan and bond investors, private equity firms, debt funds, servicers, and rating agencies.

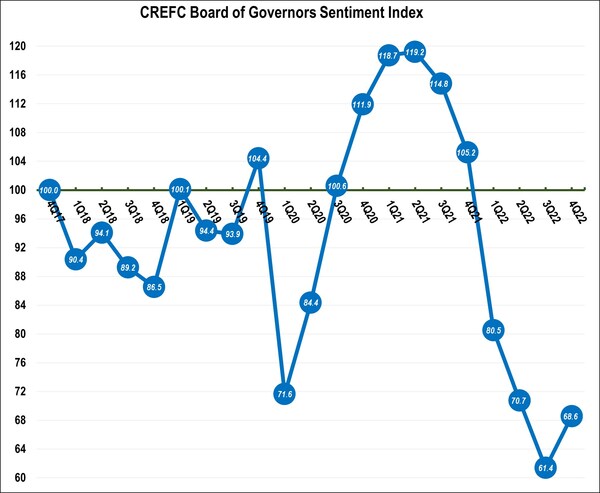

CREFC’s quarterly Sentiment Index is derived from the Board’s responses to nine core questions on the state of the CRE finance market. The Sentiment Index tracks the market pre-COVID, during COVID, and today as we continue to recover from the worst of the pandemic’s impact.

4Q 2022 Survey: Outlook Improves After Five Consecutive Quarterly Declines

Overall sentiment increased to 68.6 in 4Q 2022, up 12% from 61.4 in the prior quarter, which marked the lowest level since the survey’s inception. This was the first positive shift following five consecutive quarterly declines. While an improvement, the index remains in negative territory given the continued uncertainty surrounding inflation, rising interest rates, and a looming recession. In addition, property valuation uncertainty will continue to challenge lenders and investors in the coming year.

The BOG’s sentiment was flat to slightly upward in all nine questions. The questions with the most significant movements revolved around expectations for investor demand for CRE assets, borrower demand for financing, and liquidity in the CRE debt capital markets.

In 3Q 2022, only 11% of the Board expected more demand by investors for CRE assets, with 64% expecting less demand. In the current quarter, 22% expect more demand, with 55% expecting it will be lower. Regarding borrower demand for financing, 15% of the Board expected more demand in 3Q 2022, with 68% anticipating less demand. In the current quarter, 29% expect more demand, with 51% expecting lower demand.

Liquidity expectations also saw a positive shift in 4Q 2022. In the prior quarter, 62% expected a contraction in liquidity, with only 8% expecting an improvement. In the current quarter, 47% expect a contraction, with 18% anticipating better conditions. In addition, the rising rate environment continues to weigh heavily on the BOG, with 84% expecting rates to negatively impact the industry in the current quarter, compared to 98% in the prior quarter.

Finally, overall sentiment for all CRE finance businesses remained firmly negative. In 3Q 2022, 2% indicated a positive outlook, with 89% expressing an unfavorable view. In the current quarter, a still small 4% held a positive outlook, with 75% holding a negative view. Sentiment for the industry peaked in 2Q 2021 when the survey found that 83% had a favorable opinion, with only 3% having an opposing view.

This quarter’s survey also included two open-ended questions for the Board, separate from the questions comprising the Index. The additional questions sought to gain Board insights on topical issues facing the market. The first question asked the Board’s projection for the Federal Reserve’s benchmark policy rate in 2023 in contrast to its current target range between 4.25% and 4.50%. The median response was 5.00%, with 29% expecting the rate to fall between 4.75% and 5.00% and 24% expecting the rate to be greater than 5.00%.

Finally, members were asked to predict total private-label CMBS and CRE CLO issuance in 2023. The median response from the Board was $90 billion, or 10% lower than the full-year 2022 issuance of $100 billion.

“This most recent survey accurately captures the concerns of the industry at large at this time,” said CREFC Executive Director Lisa Pendergast. “While not a cause for celebration by any means, we hope this is the beginning of a positive streak. The reality remains that the Fed will continue to raise rates and the potential of an economic downturn still exists. We remain optimistic, however, that we are in a much better position and stronger place than we were in 2008, and we will continue to be a resource and a voice for our industry and members in these uncertain times.”

About CREFC’s Board of Governors Sentiment Index

The CRE Finance Council (CREFC) is the trade association for the commercial real estate finance industry. Over 300 companies and nearly 18,000 individuals are members of CREFC. CREFC’s members serve a critical role in the US economy by financing office buildings, industrial and warehouse properties, multifamily housing, retail facilities, hotels, and other types of commercial and multifamily real estate.

Nearly 60 senior executives in the commercial real estate finance markets represent CREFC’s Board of Governors and hail from every sector of the commercial real estate lending and mortgage-related debt investing markets. CREFC Governors include balance sheet and securitized lenders, loan and bond investors, mortgage bankers, private equity firms, loan servicers, rating agencies, attorneys, accountants, and others. CREFC’s Governors serve up to six years on CREFC’s Board and are all senior members in their firms and the industry.

CREFC’s BOG Sentiment Index aims to gauge quarter-to-quarter shifts in market conditions for the CRE finance market and the outlook for the future. The Sentiment Index equally weights the responses to each question and then sums those weighted responses to create a single index.

Media contact:

Morgan McGinnis

mmcginnis@Prosek.com

SOURCE CRE Finance Council