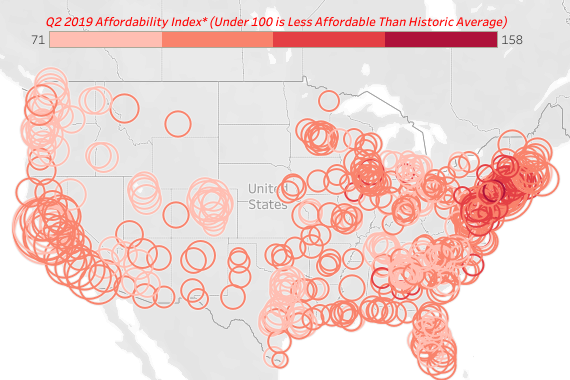

Median Home Prices Unaffordable for Average Wage Earner

Home ownership consumes 32.5% of wages in fourth quarter 2019 The fourth quarter 2019 U.S. Home Affordability Report, released in mid-December by data provider ATTOM Data Solutions, shows that median home prices in the fourth quarter of 2019 were unaffordable for average wage earners in 344 of 486, or 71% of the U.S. counties analyzed in the report. The figure represents a slight improvement from previous reports. It was down

Read More