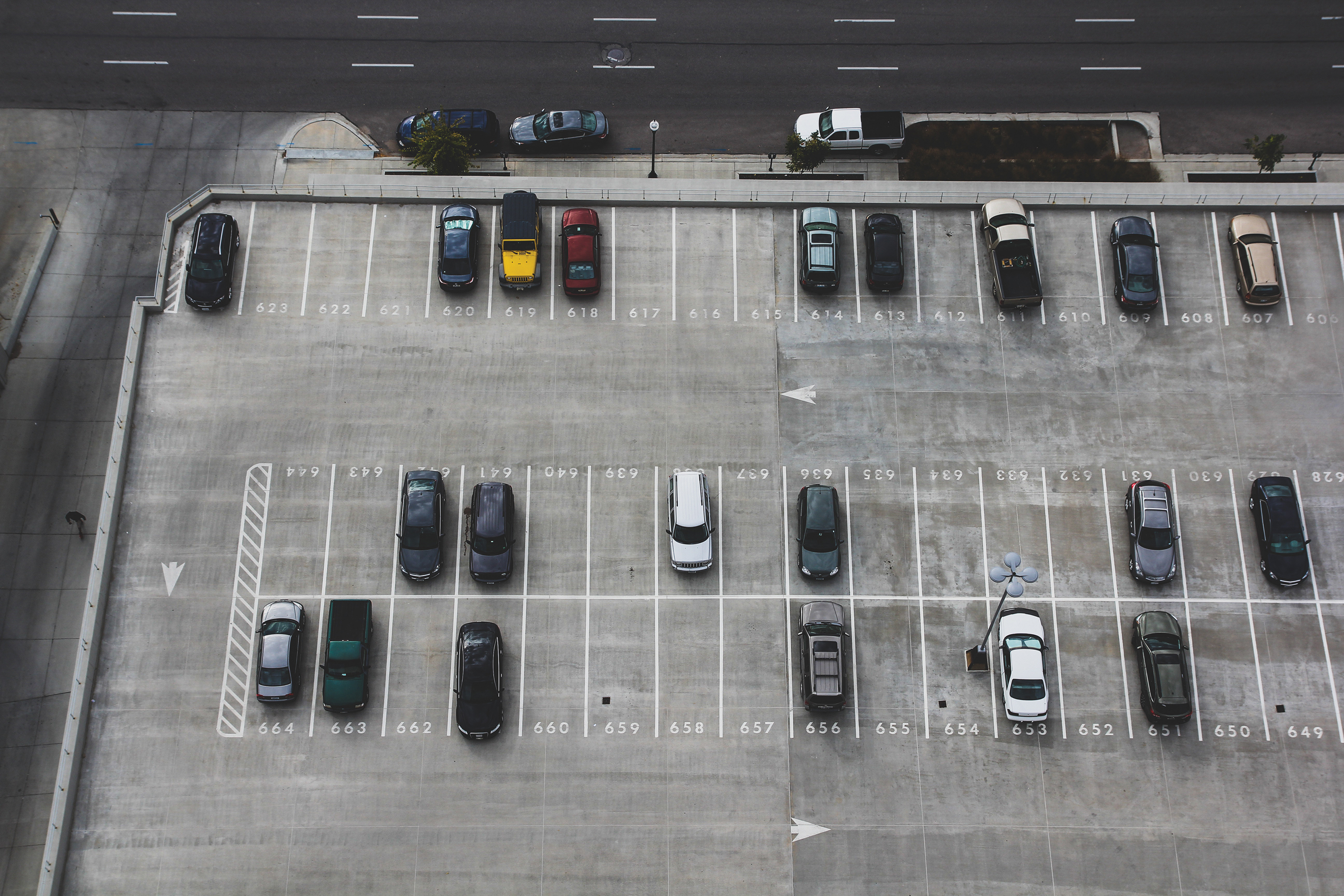

Single Family, Fix and Flip, Multi-Family… Parking Lots?

Regulatory changes open up more investment opportunities in parking lots. Real estate investors seem to be enamored by the latest trend. It’s essentially a game of buy low, sell high—and what‘s everyone else doing? You may have a REIT in your portfolio, or you may be hands-on with your properties. But, you probably don’t have a parking facility generating income for you. In fact, most people don’t. For the longest

Read More