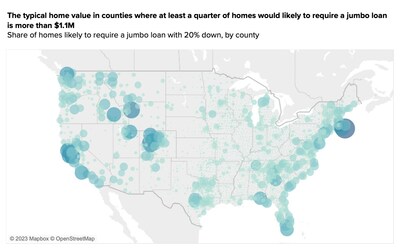

Updates to Conforming loan limits mean 2 million U.S. homes no longer require a jumbo loan

This could open up more home options for buyers shopping at higher price points and hoping to avoid the additional fees of a jumbo loan More than 2 million homes across the country no longer require a jumbo loan, according to a new analysis by Zillow Home Loans. This means customers will have additional available inventory that is covered by a more accessible financing option. The change is due to

Read More