A True Team Player

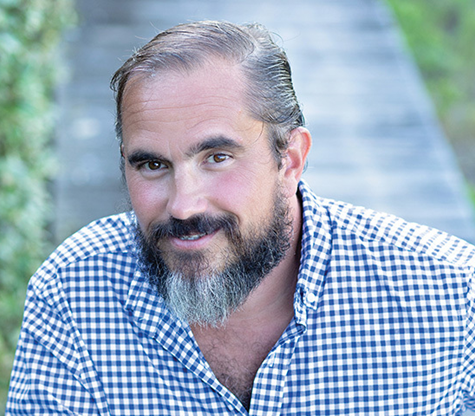

Home Depot’s Frank Blake Will Never Stop Building by Carole VanSickle Ellis Frank Blake will be the first to tell you he’s extremely grateful for his team. In fact, that is the mantra you will hear over and over in conversation if you speak with him for any length of time. “You are only as good as your team,” the Bronze Star recipient and current Home Depot general manager for

Read More